At SilverByte Imports Pvt. Ltd., everything ran like clockwork—timely shipments, smooth customs clearances, and satisfied clients. But when CPCB made quarterly and annual return filing mandatory for all e-waste importers, things changed overnight.

Their operations manager, Mehul, suddenly had to navigate obligations, metal-based EPR targets, certificate uploads, awareness documentation, and multiple dropdowns inside the CPCB portal. A single missed quarterly submission triggered a compliance alert, putting their renewal at risk.

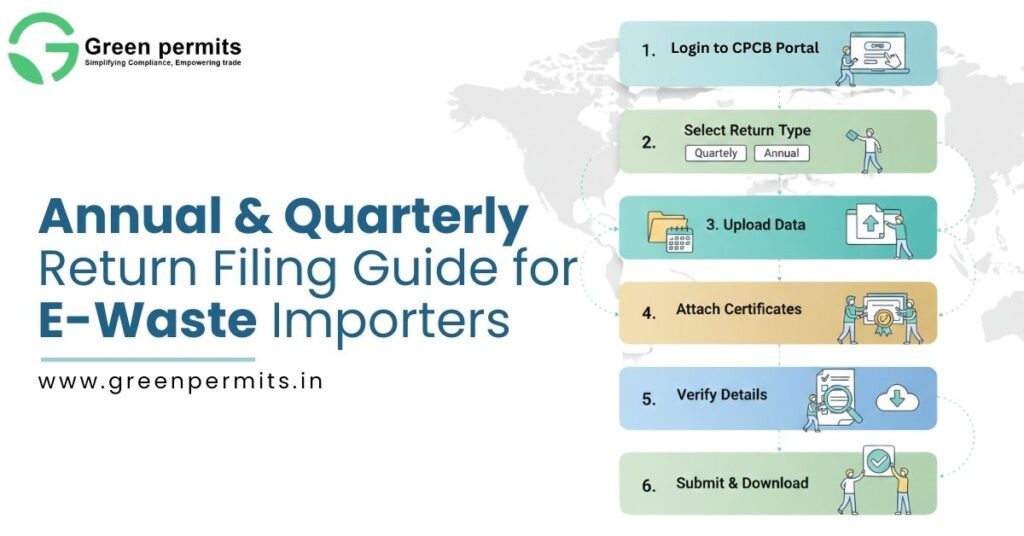

If your company has ever faced similar confusion, this guide will walk you through the process with clarity and confidence—so you never miss a deadline again.

Every importer placing electrical and electronic equipment (EEE) on the Indian market is responsible for ensuring those products are recycled at their end-of-life. CPCB’s return filing framework ensures two things:

Non-compliance leads to:

Returns aren’t just paperwork—they protect your business license and reputation.

Quarterly returns focus on ongoing compliance. They show CPCB how much of your target you achieved in each quarter and whether you used the EPR certificates correctly.

They reflect:

Deadline: 30 days after the end of each quarter.

Missing one blocks the next quarter—making it the most common reason for compliance delays.

The annual return is a holistic view of the importer’s entire year of activity. Unlike quarterly returns, this filing requires more documentation, especially awareness activities.

Annual returns include:

Deadline: 30 June every year.

Without the annual return, your renewal request is automatically rejected.

Importers must maintain these documents in order throughout the year:

Accurate documentation protects you during audits and inspections.

Once you select the quarter, the portal automatically fetches:

This pre-loaded structure ensures your filing is aligned with your registered product categories.

Your metals-based EPR obligations appear here. These include:

Each obligation depends on the product category you imported—laptops, phones, servers, televisions, etc.

This section also shows:

Depending on the quarter, you may need to confirm:

If a recycler has already uploaded the evidence, the portal auto-verifies it—preventing misreporting.

Awareness documents are optional for quarterly returns.

Once verified, click submit.

Note: The system will not allow Q2 filing unless Q1 is submitted. This sequential filing rule is strict.

This loads:

The system consolidates your quarterly data into one annual summary.

The importer must carefully review:

This is crucial because renewal depends on complete and accurate year-end compliance.

Annual return requires proof of awareness efforts, such as:

Even a simple digital awareness campaign qualifies as long as it’s documented.

Once everything is complete, submit the final annual return.

This closes your yearly compliance cycle and unlocks renewal eligibility.

Importers must verify or upload:

This ensures that reported certificates correspond to actual recycling output.

| Return Type | Frequency | Deadline | What It Includes |

|---|---|---|---|

| Quarterly Return | Every 3 months | 30 days post quarter-end | Certificates, obligations, evidence |

| Annual Return | Once yearly | 30 June | Full-year data + awareness documents |

| Registration Renewal | Every 5 years | 120 days before expiry | Only approved if all returns are filed |

Deadlines are strict, and the portal often locks the next filing if a deadline is missed.

Different EEE categories demand different metal-based EPR reporting.

For example:

| EEE Category | Example Imports | Reporting Trigger | Metals Counted |

|---|---|---|---|

| ITEW1–10 | Laptops, servers, desktops | High metal composition | Au, Cu, Fe, Al |

| ITEW15 | Mobile phones | Tiny gold but high copper | Au, Cu, Fe |

| CEEW1 | TVs and displays | Higher iron & copper | Fe, Cu |

| LSEEW items | Washing machines, ACs | Large iron content | Fe, Al |

Accurate category selection ensures accurate obligations and cleaner returns.

Choosing the wrong category changes your entire EPR obligation.

Always validate item codes before registration.

You cannot skip Q1 and jump to Q2.

This causes annual return delays and renewal issues.

A 10-gram gold certificate cannot offset a copper obligation.

Metal mismatches lead to return rejection.

Importers often forget to document awareness efforts, which are mandatory for annual returns.

Importer is ultimately responsible—not the consultant.

Always cross-check data before submission.

Case Example:

A Noida-based importer submitted their Q1 and Q3 returns but forgot Q2.

As a result:

Once they corrected the missing quarters and uploaded evidence, the portal unlocked subsequent filings.

This example shows how one missed quarter can disrupt the entire compliance cycle.

CPCB may impose:

These penalties affect both operational and financial performance.

Quarterly and annual return filing is not just a formality—it is a crucial part of your compliance lifecycle as an e-waste importer. With accurate documentation, timely uploads, and proper understanding of obligations, you can avoid penalties and maintain a clean compliance record.

If you want expert assistance in managing your filings and obligations seamlessly, our team is ready to help.

📞 +91 78350 06182

📧 wecare@greenpermits.in

It’s based on your imported EEE category and CPCB’s metal composition table.

Usually no—recycler uploads it, and you verify.

No, only annual return requires awareness proof.

No, the portal locks the annual return until all quarters are submitted.

CPCB may reject the return or send you a correction notice.