A mid-sized electronics importer in Delhi was confident about their E-Waste EPR compliance. Registration was approved, recyclers were onboarded, and certificates were uploaded on time. From the outside, everything looked compliant.

The issue surfaced months later when CPCB sent a clarification email questioning EPR target calculations and recycler certificates. No inspection. No warning. Just a request to explain the numbers. What followed was a long internal review, data corrections, and delayed import clearances — all triggered by minor inconsistencies that had gone unnoticed.

This is how E-Waste EPR audits by CPCB typically begin. They are quiet, data-driven, and often retrospective. Businesses usually realise the risk only when a notice arrives.

This article explains how CPCB conducts E-Waste EPR audits, what is examined during verification, and why even well-intentioned companies fail audits, so you can stay prepared rather than reactive.

An E-Waste EPR audit is CPCB’s method of verifying whether a producer, importer, or brand owner has genuinely met their Extended Producer Responsibility obligations under Indian regulations.

CPCB does not treat EPR as a paperwork exercise. The audit focuses on traceability — whether products introduced into the market can be reliably linked to corresponding recycling outcomes. This involves validating sales data, EPR target calculations, recycler processing records, and return filings over multiple financial years.

Unlike financial audits that occur annually, EPR audits are ongoing in nature. CPCB may examine past years if anomalies appear in current filings. For businesses, this means EPR compliance does not end once registration is granted. It continues throughout the product lifecycle.

CPCB does not randomly audit businesses. Reviews are typically triggered when submitted data behaves in ways that appear inconsistent or unusual.

Companies that frequently face audits include importers with sharp fluctuations in annual sales, producers dealing across multiple EEE categories, and businesses that revise returns after submission. Heavy reliance on a limited number of recyclers also raises scrutiny, especially when certificate volumes suddenly increase.

In practical terms, if your EPR data shows unexplained spikes, category mismatches, or timing gaps, CPCB may ask for clarification. The audit is not about suspicion — it is about data logic.

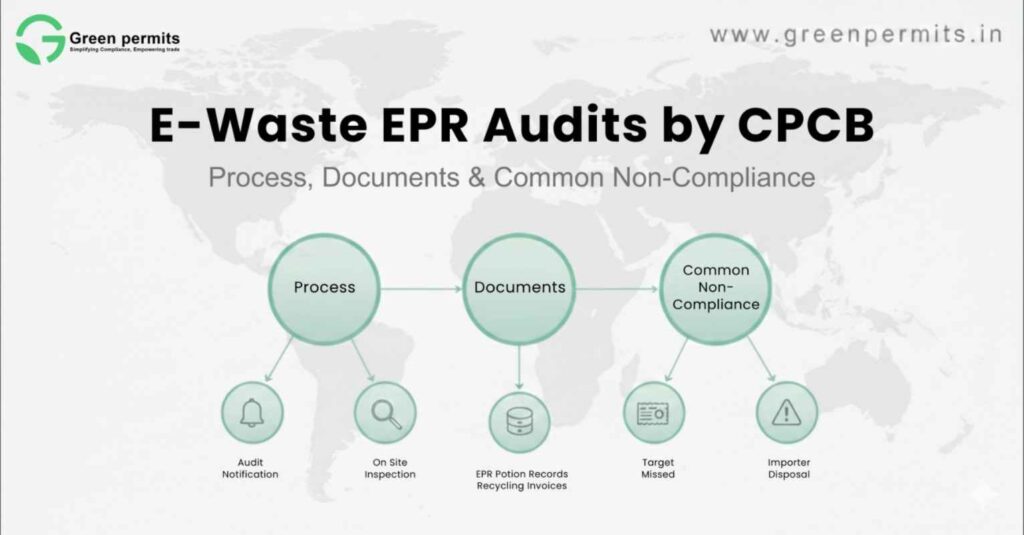

Most E-Waste EPR audits start silently, without any formal announcement. CPCB reviews the information available on the EPR portal and cross-checks it internally.

The process usually begins with a comparison of declared sales figures against automatically calculated EPR targets. CPCB then examines whether the EPR certificates uploaded genuinely cover those targets, whether they relate to the correct EEE categories, and whether the recycler issuing them was authorised and active at the time.

If CPCB identifies discrepancies, a clarification or show-cause notice is issued. Businesses are given a defined window to submit explanations, corrected data, or supporting documents. Only when inconsistencies remain unresolved does CPCB escalate to penalties or suspension.

Physical inspections are uncommon and generally occur only after serious or repeated digital non-compliance.

Documentation is the backbone of EPR audits. CPCB does not review documents in isolation; it verifies whether all records align across time, category, and quantity.

During an audit, CPCB typically examines the EPR registration certificate, year-wise product sales data, and the EEE category mapping used to calculate obligations. This is followed by scrutiny of EPR certificates generated by recyclers, including their issuance dates, quantities, and category relevance.

Annual and quarterly returns are then checked for consistency with certificate uploads. In some cases, CPCB may also review supporting business records to validate sales volumes or recycling claims.

What often causes problems is not missing documentation, but documents telling slightly different stories.

| Area Reviewed | What CPCB Checks | Why Issues Arise |

|---|---|---|

| Sales Data | Accuracy and category mapping | Products placed under wrong EEE |

| EPR Targets | Logical calculation | Misinterpretation of rules |

| Certificates | Validity and timing | Excess or mismatched certificates |

| Returns | Filing discipline | Delayed or revised submissions |

| Recycler Status | Authorisation validity | Using inactive recyclers |

This table highlights a key truth for businesses: EPR compliance fails more often due to classification and timing errors than due to lack of recycling.

Most audit failures are unintentional. They arise from operational gaps rather than deliberate avoidance.

One common issue is the use of EPR certificates issued for the wrong EEE category. Another frequent problem is purchasing excess certificates without properly adjusting obligations. Delayed return filing is also regularly flagged, even when recycling has occurred on time.

Businesses also struggle with incorrect carry-forward of deficits or surpluses and with over-reliance on consultants without internal verification. These issues remain invisible until CPCB analyses multi-year data.

| Nature of Issue | CPCB Action | Impact on Business |

|---|---|---|

| Minor mismatch | Clarification notice | Time and compliance effort |

| Incorrect data | Correction directive | Operational delays |

| Repeated issues | Environmental compensation | Financial exposure |

| Major violation | Registration suspension | Business interruption |

CPCB’s approach is progressive. Most businesses are given opportunities to correct errors, but repeated lapses significantly increase regulatory risk.

A consumer electronics brand completed recycling within the financial year but uploaded certificates after the annual return deadline. The recycling was genuine, and the quantities were accurate, yet procedural timelines were missed.

CPCB flagged the delay and issued a clarification notice. While penalties were avoided, the company spent weeks reconciling records and responding to queries, delaying product launches and diverting senior management time.

The experience highlights a critical reality: EPR compliance depends on process discipline as much as environmental responsibility.

Audit readiness does not require complex systems. It requires consistency.

Businesses that perform quarterly internal reconciliation of sales and EPR targets, verify EEE category mapping, and track recycler certificates continuously face fewer audit issues. Filing returns well before deadlines and maintaining internal compliance records further reduces risk.

When compliance is proactive, audits become confirmations rather than disruptions.

Businesses that stay aligned with EPR requirements experience fewer notices, lower corrective costs, uninterrupted imports, and smoother regulatory relationships. More importantly, compliance planning becomes predictable instead of reactive.

Delaying alignment does not reduce cost. It only increases uncertainty.

E-Waste EPR in India has evolved into an active compliance framework. CPCB audits are data-driven, retrospective, and increasingly consistent.

The real risk today is not missing registration. It is quiet non-compliance hidden in mismatched data and missed timelines.

Preparation is no longer optional — it is essential.

📞 +91 78350 06182

📧 wecare@greenpermits.in

Green Permits helps producers, importers, and brand owners maintain audit-ready E-Waste EPR compliance, from data alignment to certificate management.

It is a verification process where CPCB checks whether EPR obligations declared by a business match actual recycling and documentation.

Producers, importers, brand owners, and other registered entities can be audited based on data review.

Most audits are digital, but physical inspections may occur in serious or unresolved cases.

CPCB verifies sales data, EPR targets, recycler certificates, returns, and recycler authorisation status.

Data mismatches, unusual sales patterns, incorrect certificates, or delayed filings often trigger audits.