- Home

- About Us

- Services

- Resources

- Contact Us

- Home

- About Us

- Services

- Resources

- Contact Us

When Ravi, a Gurgaon-based importer of smart gadgets, submitted his E-waste registration application, he thought the process would be simple. But during CPCB verification, he was asked to upload his CA-certified sales data in weight instead of quantity, and his RoHS technical file wasn’t accepted because it didn’t follow the EN50581 format.

He lost 19 days just correcting documents — a delay that could have been avoided with the right checklist.

If you’re importing electronics into India, this guide gives you the complete, practical, and business-friendly list of documents needed for a smooth and successful E-waste importer registration.

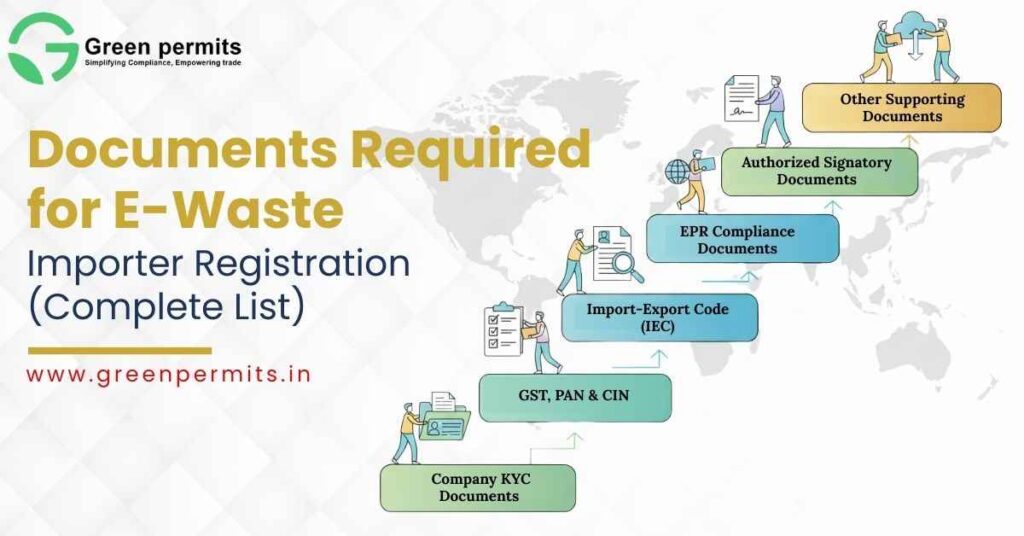

Many importers assume that registration starts with uploading sales data, but CPCB first wants to ensure your business identity is fully verified. KYC documentation is the foundation of your registration — it confirms your legal presence, verifies ownership, and ensures that GST, IEC, and trade names align correctly. Even a small mismatch can result in immediate queries from CPCB, slowing down the process.

A strong KYC submission tells CPCB that you are compliant, organized, and ready for importer-level obligations.

| Document | Mandatory | Notes |

|---|---|---|

| GST Certificate | Yes | Must match IEC address |

| PAN of Company / Proprietor | Yes | Used for identity verification |

| CIN / Incorporation | If applicable | For LLP/Private Limited |

| Authorized Person PAN | Yes | Should be consistent across forms |

| Authorized Person Aadhaar | Yes | Used for OTP verification |

| Address Proof | Yes | Registered office address |

| Website | Optional | Helps during background validation |

Humanized Insight:

Most queries during approval come from simple mismatches — like IEC showing Gurgaon but GST showing Delhi. Correct this before applying.

This is the most critical part for importers. CPCB uses IEC to validate that you are legally importing electronic or electrical products. If GST details or trade names do not align with IEC information, your registration will stay pending until corrected.

Since many importers sell under foreign brand names, CPCB also checks brand ownership or authorization before granting approval.

| Document | Purpose | Common Issues |

|---|---|---|

| IEC Certificate | Proof of import rights | Address mismatch with GST |

| GST Certificate | Business verification | Trade name differences |

| Brand Declaration | Required for foreign brands | Missing authorization letter |

| EEE Category List | Maps to CPCB codes | Wrong codes selected |

Humanized Insight:

One importer mistakenly selected “ITEW5” for laptops instead of the correct laptop code category. This small mistake delayed approval by two weeks. Double-check before submitting.

This is where most importers get stuck. CPCB does not accept sales data in pieces, cartons, or units. The portal strictly requires weight-based data (in kilograms or metric tonnes), verified by a Chartered Accountant.

If you’re a new importer, year-wise entries will simply reflect “0” until your first import year.

| Financial Year | Quantity Imported (MT) | Quantity Sold (MT) | Verified By |

|---|---|---|---|

| 2019–20 | X MT | X MT | Chartered Accountant |

| 2020–21 | X MT | X MT | Chartered Accountant |

| 2021–22 | X MT | X MT | Chartered Accountant |

Humanized Insight:

A Chennai importer submitted sales in pieces like “15,000 watches.” CPCB rejected it because weight details were missing. Always convert to MT.

RoHS compliance is mandatory under Rule 16. Many importers think a simple declaration is enough — but CPCB actually requires a detailed technical file aligned with EN50581, including material composition, safety certifications, and chemical test reports.

| Document | Required | Notes |

|---|---|---|

| RoHS Self Declaration | Yes | Auto-generated during registration |

| EN50581 Technical File | Yes | Mandatory for all producers/importers |

| Laboratory Test Reports | Yes | Should cover key hazardous substances |

| Product List (Enclosure A) | Yes | Must match CPCB EEE codes |

Humanized Insight:

A large importer of Bluetooth speakers submitted RoHS without OEM test reports. CPCB flagged the application, causing a 22-day delay. Have all OEM reports ready.

CPCB requires importers to demonstrate how they will educate customers about responsible disposal of electronic waste. This ensures that importers contribute to public awareness and environmental responsibility.

Humanized Insight:

Most importers simply upload a one-page note. A more detailed awareness plan speeds up approval and shows you are serious about compliance.

CPCB reviews every document thoroughly. Any mismatch or missing document leads to a query or application rejection — delaying your business operations.

If you’re importing electronic products into India, CPCB requires a precise and complete set of documents to approve your E-waste registration. Preparing the right documents in advance — correctly formatted, RoHS-compliant, and verified — can save you weeks of delays and prevent costly mistakes.

For smooth, accurate, and expert-guided EPR importer registration:

📞 +91 78350 06182

📧 wecare@greenpermits.in

Book a Consultation with Green Permits

KYC documents, IEC, GST, CA-certified sales data, RoHS documents, and an awareness plan.

Yes, IEC is required to prove you are legally importing electrical/electronic items.

Yes, EN50581-based documents are compulsory.

Yes, but you must enter ‘0’ for years before your business started.

Most rejections happen due to IEC–GST mismatches or incomplete RoHS documentation.