When NorthByte Imports Pvt. Ltd., a mid-size Delhi-based electronics importer, got a message from their customs broker saying, “Sir, your consignment is enjoying an extended stay at the port,” the team chuckled for a moment. The humour disappeared quickly when they learned the real issue — the company didn’t have an E-Waste EPR registration number under the 2022 rules.

Stories like this are becoming common. Many small importers still assume EPR applies only to large manufacturers. Reality sets in when warehouse charges begin to accumulate and delivery commitments start slipping.

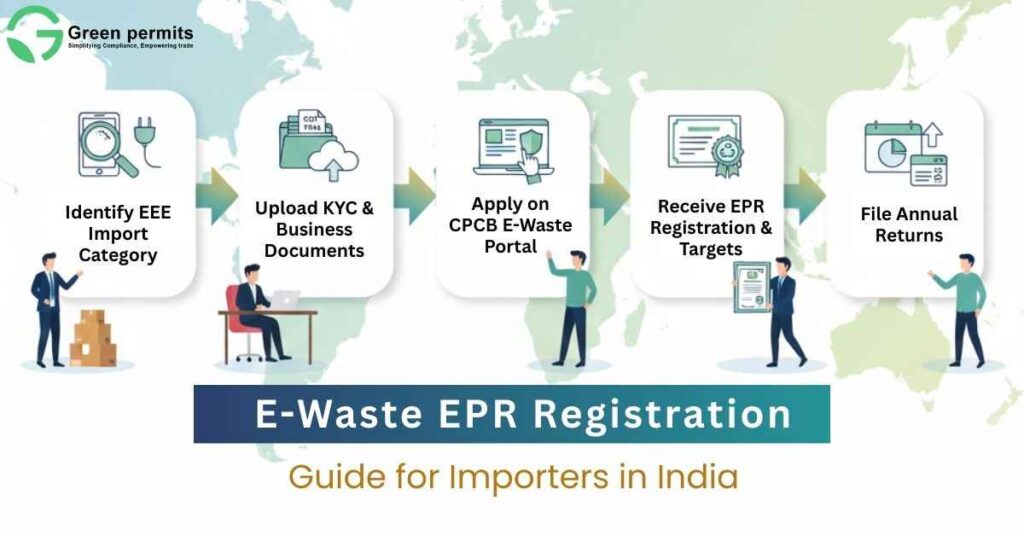

The good news? Once importers understand how EPR rules apply to them, the registration process becomes much more manageable. With the right documentation and a structured plan, businesses can complete approval smoothly and avoid unnecessary disruptions.

Many importers don’t realise they are categorised as “Producers” under the E-Waste Management Rules, 2022. This classification applies because importers introduce electrical and electronic equipment into the Indian market.

A Jaipur-based importer mentioned that once his import weight details were corrected and verified by a CA, CPCB approved his registration within three weeks.

CPCB validates both your business identity and the nature of the electronics being imported. This makes accuracy essential.

Importers frequently face delays due to submitting quantity-based import data instead of weight-based data. CPCB requires weight data only.

Once logged into the CPCB portal, importers follow a systematic process. Small mistakes—like mismatched dates or incorrect file formats—often cause unnecessary delays.

A compliance advisor mentioned that many applications fail simply because importers submit incorrect year ranges in the import data section.

After registration, importers receive annual recycling obligations based on the volume and type of electronics placed in the Indian market. These obligations must be met by obtaining EPR recycling certificates.

Below is an easy-to-understand break-up of typical target ranges.

| Annual EEE Placed on Market (MT) | Typical Recycling Target (%) | Interpretation |

|---|---|---|

| 0–50 MT | 15–20% | Suitable for small importers |

| 50–200 MT | 20–30% | Moderate targets with gradual yearly increase |

| 200–1000 MT | 30–40% | Higher responsibility due to larger market presence |

| 1000+ MT | 40–70% | Large importers must plan for significant obligations |

Interpretation:

Your obligation grows as your import volume increases. Importers must purchase EPR certificates from CPCB-registered recyclers to meet these obligations.

Certificates purchased from unregistered recyclers are invalid and may lead to penalties.

The compliance journey continues even after registration. Annual returns summarise your import activity, certificate purchases, and compliance status.

Returns must be filed before June 30 every year.

| Mistake | Impact | How to Prevent |

|---|---|---|

| Incorrect import weight | Mismatched targets and delays | Use CA-certified data |

| Certificates from unregistered recyclers | Certificates become invalid | Verify recycler status |

| Missing awareness proof | Return may be rejected | Upload basic compliance material |

| Filing late | Penalties and renewal delays | Set internal reminders |

One Bengaluru importer shared that a small typo in his import data delayed renewal by nearly two months—highlighting the need for accuracy.

Ignoring EPR compliance can create significant operational challenges for importers.

For small importers, even a short delay in clearance can disrupt operations and cash flow.

E-Waste EPR registration is essential for every importer in India dealing with electrical and electronic equipment. Completing registration early, keeping data accurate, and working only with registered recyclers protects your business from customs delays, penalties, and compliance disputes.

A structured approach to documentation and filing makes the process significantly smoother.

If you need help with documentation, portal submission, or annual return filing, expert support can save time and reduce risk.

📞 +91 78350 06182

📧 wecare@greenpermits.in

Book a Consultation with Green Permits

Yes. Importers are treated as Producers and must register before importing electronics.

GST, PAN, IEC, company KYC, CA-certified import data, and declarations.

Usually 15–30 working days if all details are accurate.

Shipments may get stopped at customs and penalties may apply.

By purchasing recycling certificates from CPCB-registered recyclers.