- Home

- About Us

- Services

- Resources

- Contact Us

- Home

- About Us

- Services

- Resources

- Contact Us

A few months ago, a small business owner from Vadodara approached us with a simple plan: convert his family’s scrap business into a formal e-waste recycling operation. He had already sourced a shed, contacted machinery suppliers, and lined up a scrap dealer network.

But when his first application to GPCB came back with queries, he realised something most new entrepreneurs don’t:

Success in this sector depends less on machines and more on understanding the regulatory ecosystem, layout planning, and metal recovery compliance.

This guide helps you avoid these early mistakes and build a sustainable, compliant, and profitable e-waste recycling plant in Gujarat.

Gujarat’s manufacturing base, port-driven logistics, and strong industrial infrastructure make it one of the best states to launch an e-waste recycling facility. The state consistently ranks among India’s top contributors in both industrial output and e-waste generation.

E-waste recycling thrives in locations where three factors align:

Gujarat ticks all boxes.

Ahmedabad, Surat, Vadodara, Gandhinagar, and Rajkot house corporate parks, IT offices, textile machinery units, and telecom networks — all major e-waste generators. Additionally, the state’s ports allow easy import of machinery and export of recovered metals.

A growing circular economy mindset means more companies want certified disposal partners, opening the door for long-term contracts and stable revenue streams for recyclers.

Choosing the right location is often the difference between quick approvals and months of delays. E-waste operations require space, power load, transport access, and hazardous waste-friendly zoning.

Dahej (Bharuch): Ideal for medium-to-large recyclers due to port proximity and established industrial infrastructure.

Sanand (Ahmedabad): Electronics manufacturing belt with steady e-waste supply.

Vapi (Valsad): Known for waste-handling facilities and cost-effective land options.

Hazira (Surat): Heavy machinery units and port access make it efficient for bulk inflow.

These factors directly affect operational efficiency and compliance adherence.

The long-term viability of an e-waste plant depends on consistent inflow. Many new recyclers underestimate how quickly scrap stock depletes once operations begin.

More companies are shifting from informal scrap dealers to formal recyclers to ensure data security, regulatory compliance, and audit-ready disposal certificates. This shift improves margins for authorized recyclers.

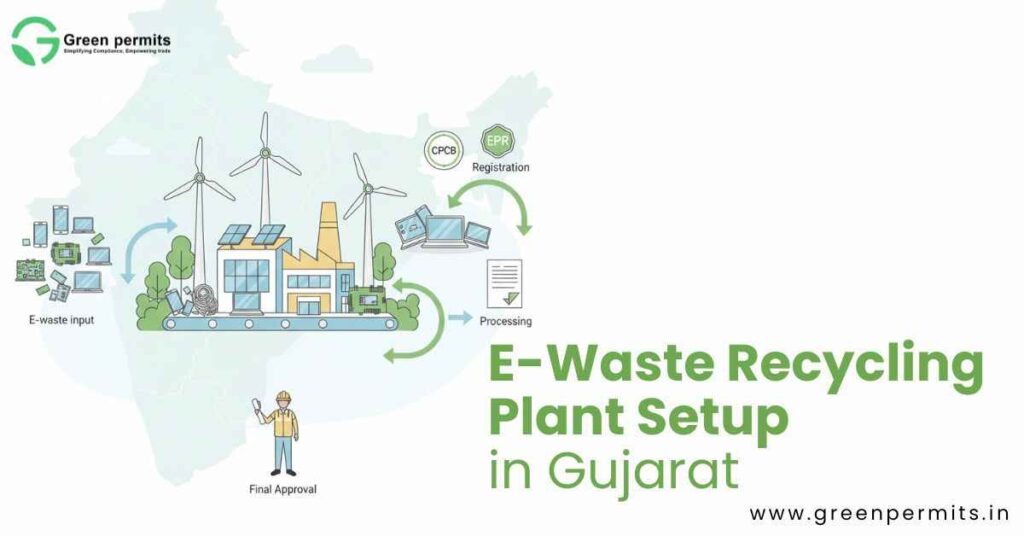

For anyone learning how to start an e-waste recycling plant in Gujarat, regulatory approvals form the backbone of the project. Without these, machinery installation or commercial operations cannot legally begin.

Most delays occur due to improper plant layout or missing documents such as geotagged machinery photos, waste storage area maps, or process flow diagrams.

Planning documentation correctly can reduce approval time by several weeks.

Operating without authorization can lead to plant shutdown, seizure of materials, and environmental compensation penalties. In Gujarat, these penalties can become substantial depending on volume handled.

Machinery selection determines operating cost, recovery efficiency, and EPR certificate generation potential.

| Component | Typical Cost (₹ lakh) | Business Explanation |

|---|---|---|

| Land (10,000 sq ft, GIDC) | 25–40 | Cost varies by zone and proximity to cities |

| Shed + Civil Work | 20–35 | Includes flooring, ventilation, electricals |

| Manual/ semi-automatic dismantling line | 10–20 | Suitable for small-to-mid units |

| Shredder + magnetic/eddy separation | 35–70 | Essential for high metal recovery |

| Pollution control systems | 10–25 | Dust collectors, scrubbers, chimneys |

| Precious metal refining line | 40–120 | Optional, used by advanced recyclers |

| Laboratory setup | 5–10 | Required for quality testing and EPR reporting |

If budget is tight, start with dismantling + basic shredding. Refining facilities can be added once consistent inflow and cashflow are established.

| Expense | Cost (₹ lakh/month) | Notes |

|---|---|---|

| Labour | 3–5 | Skilled dismantlers improve metal recovery |

| Electricity | 1.5–3 | Shredders consume significant power |

| Scrap Procurement | 8–15 | Your largest recurring expense |

| Transport | 1–2 | Varies by sourcing radius |

| Compliance & Waste Disposal | 0.5–1 | Includes testing, record-keeping |

Scrap procurement cost directly impacts profitability. Long-term contracts with corporates and IT companies can stabilize margins even when market scrap rates fluctuate.

Gujarat’s industrial policies offer attractive incentives for recycling, waste management, and circular economy projects.

Subsidies reduce upfront investment and lower operating costs, accelerating breakeven. Many recyclers achieve payback within 2.5–4 years depending on scale.

Gujarat’s diversified industrial ecosystem makes it an attractive ground for e-waste processing businesses.

To operate legally in Gujarat, recyclers must adhere strictly to national rules governing e-waste management.

Recyclers must maintain audit-ready records at all times. Lack of documentation can trigger inspections and penalties even if actual operations are compliant.

A well-planned roadmap reduces delays and ensures smooth commissioning.

Each step builds toward full compliance and authority to generate EPR credits.

Starting an e-waste recycling plant in Gujarat offers strong long-term potential, thanks to the state’s industrial diversity, consistent scrap supply, and supportive policy environment.

However, the sector demands meticulous compliance, accurate documentation, and a clear understanding of metal recovery processes.

Entrepreneurs who prepare well, plan approvals early, and build strong supply networks consistently outperform the market.

To help you set up a compliant, financially strong, and scalable e-waste recycling plant:

📞 +91 78350 06182

📧 wecare@greenpermits.in

Book a Consultation with Green Permits

₹40 lakh to ₹3 crore depending on capacity, machinery and metal recovery process.

CTE, CTO, Hazardous Waste Authorization, CPCB Recycler Registration, Factory License, Fire NOC.

Dahej, Vapi, Hazira, and Sanand due to industrial infrastructure and sourcing access.

Copper, aluminum, iron, plastics, PCB metals, and precious metals like gold.

Typically 60–120 days depending on GPCB processing and documentation quality.