- Home

- About Us

- Services

- Resources

- Contact Us

- Home

- About Us

- Services

- Resources

- Contact Us

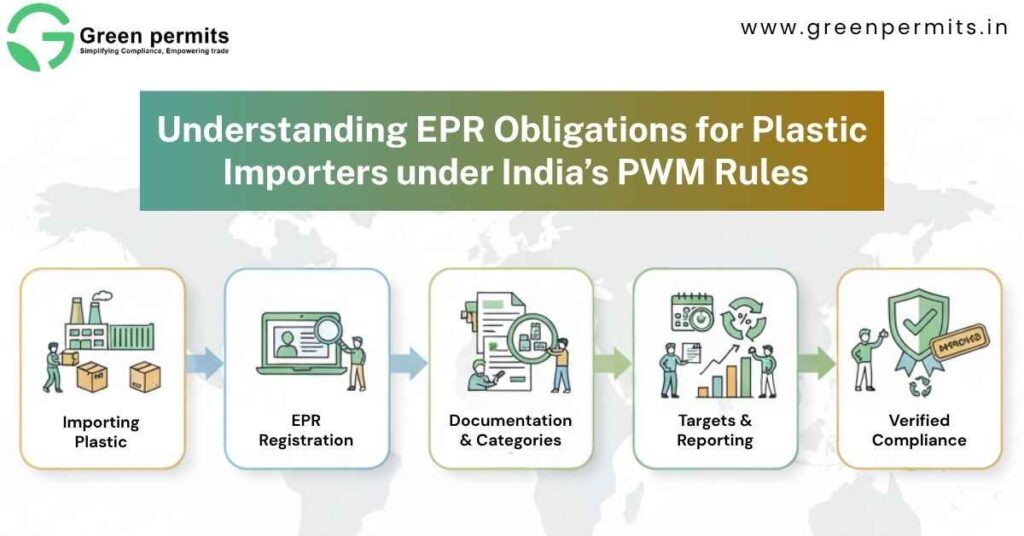

If you’re importing products into India today, there’s a new kind of paperwork that can stop your shipment at the port — and it’s not GST, BIS, or FSSAI.

It’s EPR compliance under the Plastic Waste Management (PWM) Rules.

Many importers learn about it only when customs officers ask for their EPR Registration Certificate, usually when a container is already sitting at the terminal and detention charges are rising by the hour.

This guide is designed to make sure you’re not one of them.

It explains, in straightforward language, what EPR means for plastic importers, how targets are calculated, the registration process, and the risks of ignoring it — all in the most practical way possible.

Extended Producer Responsibility (EPR) is a simple concept:

If you bring plastic into India, you must ensure that an equivalent amount of plastic waste is collected and processed.

Under the PWM Rules, every entity that places plastic packaging into the Indian market is legally responsible for its end-of-life management. This covers:

In short, if plastic enters India because of you — even indirectly — you likely fall under the EPR framework.

For compliance, an importer is any company or individual who:

You are considered a PIBO – Importer, which stands for:

Producer / Importer / Brand Owner (Importer category).

If plastic doesn’t leave the Indian market, you are responsible for it.

Use this table to confirm.

| Scenario | EPR Required? | Reason |

|---|---|---|

| Importing FMCG goods packed in plastic bottles, pouches, wrappers | Yes | You are placing this packaging into Indian circulation |

| Importing plastic granules, films, rolls, preforms | Yes | You are importing plastic packaging material itself |

| Importing electronics packed with thermocol, bubble wrap, multilayer films | Yes | All plastic packaging must be accounted for |

| Importing machinery with minimal packaging | Yes (usually) | Even small volumes count, though obligations may be lower |

| Importing goods strictly for re-export | No | Packaging doesn’t remain in India |

| Not importing at all; buying domestically | No (as importer) | You may still need EPR as a producer/brand owner, but not as an importer |

If your packaging stays in India, EPR applies.

Once you fall under the importer category, these are your responsibilities:

You must register on the official CPCB EPR portal designed for PIBOs. Operating without registration is a compliance violation.

Importers must report:

Your “eligible quantity” is calculated based on:

Most importers must meet 100% of their eligible plastic packaging quantity through recycling, co-processing, or other approved processing.

Only registered PWPs can issue valid certificates.

Your targets are fulfilled by purchasing digital EPR certificates generated when PWPs process an equivalent quantity of plastic.

Importers must submit annual returns by 30 June every year with details of:

Missing deadlines triggers scrutiny and can lead to compensation charges.

Plastic packaging is classified into four categories. Importers need to report category-wise data because each category has its own recycling target.

| Category | Examples | Notes |

|---|---|---|

| Category I – Rigid Plastic | Bottles, caps, jars, containers | Common in FMCG imports |

| Category II – Flexible Plastics | Pouches, bags, wraps, films | Most electronics are packed in these |

| Category III – Multilayered Packaging (MLP) | Chips packs, laminated pouches | Hardest to recycle, higher scrutiny |

| Category IV – Compostable Plastics | Certified compostable bags | Requires proper certification |

Understanding your packaging mix helps you estimate your EPR liability effectively.

This section is based on the official CPCB SOP for PIBO registration.

Typical documents include:

The portal requires:

Registration fee depends on your annual plastic waste generation (TPA).

The application must be processed within 15 days.

If delayed, the system can auto-approve as “deemed registration”.

| Annual Plastic Waste Generation (TPA) | Registration Fee (₹) |

|---|---|

| Less than 1,000 TPA | 10,000 |

| 1,000 – 10,000 TPA | 20,000 |

| Above 10,000 TPA | 50,000 |

Annual Processing Fee:

25% of the registration fee, paid during annual return filing.

Your EPR compliance depends heavily on your partners.

A registered Plastic Waste Processor (PWP) is authorized to:

Importers purchase these certificates to meet their annual obligations.

Working only with registered PWPs ensures transparency, traceability, and regulatory acceptance.

This is where most importers face trouble.

Customs authorities increasingly ask for EPR details.

Missing registration can pause clearance, delaying deliveries and increasing demurrage.

Failure to meet annual EPR targets can result in financial penalties calculated by regulators.

If any information is found incorrect or incomplete, your registration can be revoked for up to a year.

Large buyers, distributors, and e-commerce platforms now ask for EPR compliance before onboarding.

Ignoring EPR is no longer a small issue — it is a business risk.

Here’s a practical roadmap for importers to get fully compliant.

By day 90, your EPR system should run smoothly.

EPR is not just another regulatory requirement — it’s now a decisive factor in how smoothly your business operates in India.

Plastic importers who comply early enjoy:

Those who delay often face the opposite.

If you want help calculating your exact EPR obligation, registering on the portal, or setting up a long-term compliance plan, support is just a call away.

📞 +91 78350 06182

📧 wecare@greenpermits.in

Book a Consultation with Green Permits Today

Yes. Anyone importing plastic packaging or products with plastic components must register under the EPR framework and meet annual recycling targets.

Importers must track how much plastic they bring into India, meet recycling targets through registered processors, and submit annual returns to CPCB every year.

You need basic company documents (GST, PAN, CIN), import data from the last two years, packaging category details, and KYC of the authorized person.

Targets are based on the amount of plastic you imported in previous years. CPCB’s portal automatically calculates how much you must recycle each year.

CPCB can impose penalties, block imports, or take legal action. Non-compliance can also affect renewal of your EPR registration.