- Home

- About Us

- Services

- Resources

- Contact Us

- Home

- About Us

- Services

- Resources

- Contact Us

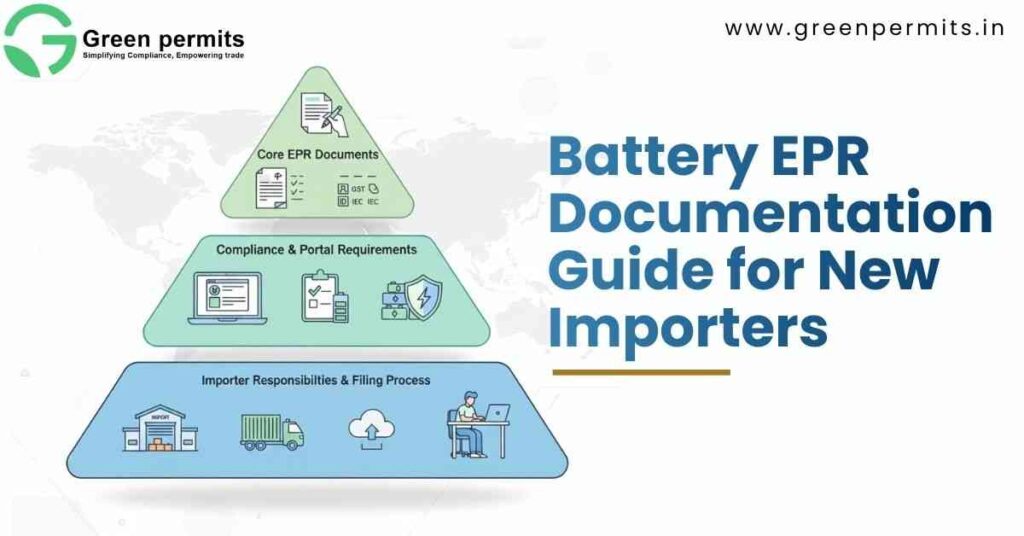

When Arnav, a first-time battery importer from Mumbai, tried applying for EPR registration, he assumed everything was in order. But a small mismatch between his GST and IEC caused the portal to reject his application. What should’ve taken five days turned into three weeks of delay and customs trouble.

This is the experience many new importers face. This guide is written to help you avoid these issues by preparing the right documents from day one.

CPCB checks every detail before approving a new importer. If your uploaded documents don’t align—name mismatches, wrong brand declaration, incomplete technical details—the entire application stalls.

A clean, consistent document set ensures faster approval, no customs delays, and smooth compliance.

Before verifying your company, CPCB verifies who is responsible for compliance.

| Document | Why It’s Needed | Preparation Tips |

|---|---|---|

| PAN (Authorized Person) | Confirms identity | Should match Aadhaar and GST details |

| Aadhaar Card | Verifies identity | Upload clear, color scan |

| Authorization Letter / Board Resolution | Confirms signing authority | Must name the authorized signatory |

| Active Mobile Number & Email | Used for OTP and login | Must belong to your business, not your consultant |

These documents establish your company’s legal identity.

| Document | Required For | Notes |

|---|---|---|

| GST Certificate | All importers | Address must match IEC and CIN |

| CIN (for Pvt Ltd/LLP) | MCA-registered companies | Ensure updated details |

| Company PAN | All companies | Upload color PDF |

| Import Export Code (IEC) | Mandatory for importers | Must match GST and authorized person details |

| DIC Certificate (optional) | Small industries | Upload only if applicable |

| Field / Document | Why CPCB Asks | What You Must Prepare |

|---|---|---|

| Battery Type (Portable/Automotive/EV etc.) | Defines EPR target category | Match with import product |

| Battery Chemistry (Li-ion, Lead-Acid etc.) | Determines key metal recovery | Ask your supplier for spec sheet |

| HSN Code | Customs classification | Use correct 8-digit HSN |

| Brand Name | Tracks responsibility for waste | Use your own brand, not exporter’s |

| Battery Composition (%) | Used for EPR target calculation | Supplier must provide material breakdown |

| Expected Annual Import Quantity | For new importers without sales history | Provide realistic estimate |

New importers often don’t have past-year sales. The portal allows entering “0” for previous years as long as battery specifications are accurate.

| Document | Purpose | Notes |

|---|---|---|

| Proforma Invoice or First Shipment Invoice | Validates imported products | PDF, well-scanned |

| SPCB Consent + Hazardous Waste Authorization | Required only if you store batteries in India | Not mandatory for all importers |

| Awareness Plan (for annual returns) | Required under EPR rules | Simple PDF is enough |

| Office Address Proof | Verifies registered address | Use rent agreement or electricity bill |

| Category | Document List | Applies To |

|---|---|---|

| KYC Documents | PAN (authorized signatory), Aadhaar, authorization letter | All importers |

| Business Documents | GST, CIN (if applicable), Company PAN, IEC | All importers |

| Technical Battery Docs | Type, chemistry, brand, HSN, weight, composition | Mandatory |

| Compliance Docs | Awareness plan, SPCB consents (if applicable) | Depends on setup |

| Supporting Docs | Invoices, DIC (optional), address proof | Case-by-case |

Using consultant contact details

CPCB only accepts the importer’s authorized signatory’s mobile and email.

Entering the foreign supplier’s brand name

If batteries are imported, you must create your own brand entry on the portal.

Wrong or unrealistic battery composition values

CPCB validates this against known chemistry standards.

Mismatched GST, CIN, and IEC details

Even a small discrepancy across documents leads to rejection.

A Delhi-based importer applied for EPR using the brand name of his Chinese supplier. He also uploaded a generic battery spec sheet without metal composition.

CPCB immediately raised an objection. Once he updated the brand to his own, added correct composition, and matched his KYC with GST and IEC, his registration was approved in six days.

Battery EPR registration becomes straightforward when your documentation is accurate, consistent, and complete. As a new importer, preparing these documents early saves days—sometimes weeks—of back-and-forth, prevents customs delays, and keeps your business fully compliant.

For support with documentation or portal filing:

→ +91 78350 06182

→ wecare@greenpermits.in

→ Book a Consultation with Green Permits

You mainly need GST, PAN, CIN, IEC, sales data, and basic KYC of your authorised person — all in PDF, clear and readable.

Because CPCB uses this info to calculate your recycling targets and verify your compliance path.

No — if you're new, you can submit “0” for past years and upload current business details.

Mostly yes, but importers must additionally upload an IEC certificate and correct HSN codes for imported batteries.

All files should be in PDF, clear, under size limits, and must match the company details you enter during signup.