- Home

- About Us

- Services

- Resources

- Contact Us

- Home

- About Us

- Services

- Resources

- Contact Us

When Raghav launched his recycling startup in 2023, he believed black mass refining was simply about extracting cobalt and lithium from old batteries. He invested in good machinery, hired a technician, and rented a warehouse outside Vadodara.

But soon, things changed.

His first batch of LFP black mass arrived. The material had no cobalt and no nickel, making his financial model collapse instantly. His second batch contained high moisture content, lowering leaching efficiency and increasing acid consumption. His third batch failed SPCB norms because the effluent TDS index shot up due to poor neutralization.

Three months in, he realised black mass processing is not a scrap business—it’s a chemical engineering, process control, and compliance-driven industry.

This guide simplifies the entire landscape so founders like Raghav make informed decisions early, without burning capital or facing compliance notices.

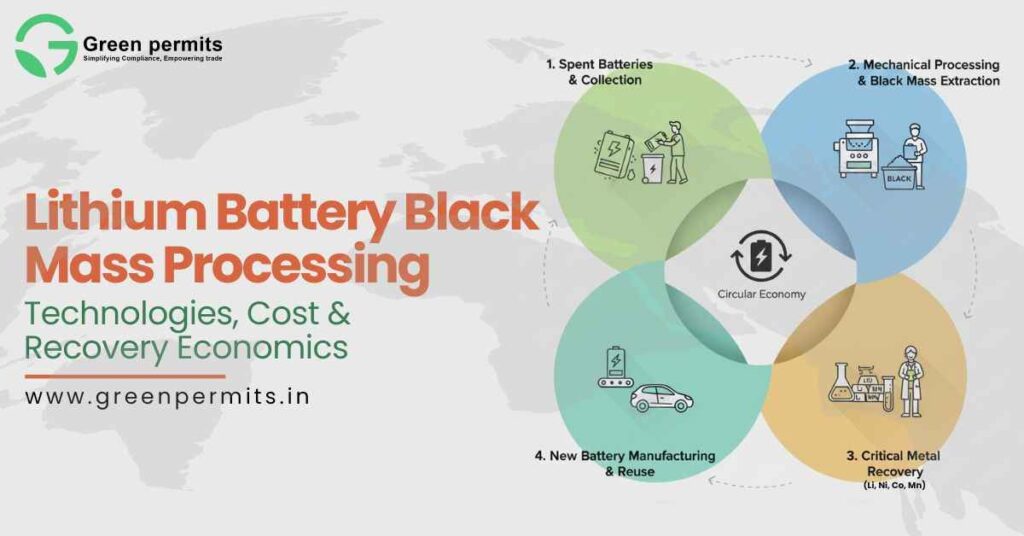

Black mass is the fine, powder-like material produced after lithium-ion batteries are dismantled, shredded, and separated. It contains a mix of valuable materials such as lithium, cobalt, nickel, manganese, copper, graphite, and aluminum.

In India’s context, black mass plays a transformative role for three reasons:

The rise of two-wheelers, three-wheelers, and renewable storage solutions means India will soon generate tens of thousands of tonnes of spent lithium-ion batteries every year.

India currently imports almost all of its lithium, nickel, and cobalt. Refining black mass domestically allows companies to reduce foreign dependence while securing strategic materials.

With new battery waste management regulations, companies are encouraged to recycle and recover input materials instead of relying on mining.

This makes black mass the centre point of India’s future battery material supply chain.

Different battery chemistries produce different grades of black mass. For recyclers, these variations greatly influence revenue and processing strategy.

| Chemistry | Lithium | Nickel | Cobalt | Manganese | Copper | Iron | Aluminium |

|---|---|---|---|---|---|---|---|

| NMC | 1–2% | 12–16% | 8–12% | 4–8% | 12–18% | 5–10% | 20–25% |

| LFP | 1–2% | 0% | 0% | 0% | 5–10% | 40–45% | 5–10% |

| LCO | 2–4% | 1–2% | 15–20% | 0% | 5–10% | 15–20% | 4–8% |

A recycler’s profitability depends heavily on the chemistry mix they receive.

Most Indian recyclers follow a semi-automated or hybrid process to generate black mass. Although global manufacturers use fully automated lines, Indian recyclers often balance cost with efficiency.

Batteries are discharged in saline or controlled electrical rigs to prevent fire hazards.

Outer casing, plastic components, and modules are separated manually.

Batteries are shredded in inert or nitrogen atmospheres to avoid thermal runaway.

Ferrous and non-ferrous metals are separated, leaving behind concentrated black mass.

Some plants employ thermal or water-based washing before supplying black mass to refiners.

Due to labour efficiency and capital constraints, Indian recyclers prefer manual dismantling + semi-automated shredding, which reduces capex but requires strong safety SOPs.

Choosing the right processing method is the single most important decision for any entrepreneur in this field. Each technology impacts capex, recovery percentage, operational cost, and regulatory compliance.

Hydrometallurgy uses acid leaching, solvent extraction, and precipitation to recover battery-grade metals.

Hydrometallurgy is ideal for most Indian entrepreneurs starting with black mass refining.

Pyrometallurgy involves smelting black mass at extremely high temperatures, producing a metallic alloy and slag.

Pyromet is best suited for large metal groups or integrated refinery operators.

Some of India’s most advanced recycling companies use hybrid processes combining thermal pretreatment with hydrometallurgical refining.

Hybrid systems strike a balance between capital investment and oil recovery economics.

Indian recyclers must plan for both capex and opex before entering black mass refining.

| Component | Hydromet Process | Pyromet Process |

|---|---|---|

| CAPEX for 5 TPD Plant | ₹12–22 crore | ₹45–70 crore |

| OPEX per Tonne | ₹22,000–₹38,000 | ₹40,000–₹55,000 |

| Energy Usage | Low | High |

| Manpower | Moderate | High |

| Lithium Recovery | 60–90% | <20% |

| Recovery of Ni/Co/Mn | 90–95% | 85–90% |

Small and mid-sized entrepreneurs can enter the market more safely through hydrometallurgy due to lower upfront investment and superior recovery.

Pricing depends heavily on chemistry, quality, and global metal markets.

Prices fluctuate based on moisture content, purity, and region.

Many Indian recyclers face losses when buying LFP black mass due to its low cobalt and nickel content unless they operate efficient lithium extraction lines.

Recovery rates depend on the process, feedstock, and purification stages.

| Metal | Hydromet Recovery | Pyromet Recovery |

|---|---|---|

| Lithium | 60–90% | <20% |

| Cobalt | 90–95% | 85–90% |

| Nickel | 90–95% | 85–90% |

| Manganese | 90–95% | 80–85% |

| Copper | 98%+ | 98%+ |

Hydromet consistently delivers higher purity and recovery, making it more attractive for Indian businesses.

Setting up a black mass refining unit requires strict regulatory adherence. Most entrepreneurs underestimate the compliance load, leading to delays and penalties.

Compliance failures lead to shutdowns, fines, and EC penalties.

In 2024, a Surat-based recycler attempted to scale their hydromet plant without upgrading the effluent treatment line. Within weeks:

After proper redesign, they achieved:

This example shows that technology alone isn’t enough. A strong compliance and quality system is equally important.

Yes, if approached with the right technology, chemistry mix, and compliance systems.

Revenue potential:

₹3.5 to ₹6.5 lakh per tonne (depending on chemistry)

Operating margins:

Payback period:

Hydromet plants offer stronger financial performance for small and mid-sized investors.

India is entering a critical decade where domestic refining of black mass will determine the nation’s independence from imported battery materials. With EV adoption rising, recycling will become as important as manufacturing.

Entrepreneurs who invest early—while choosing the right technology and ensuring compliance—will have significant market advantages, including better margins, premium buyers, and strong investor confidence.

Delaying investment could mean facing higher competition and tighter regulations later.

Our team at Green Permits helps with:

📞 +91 78350 06182

📧 wecare@greenpermits.in

Book a Consultation with Green Permits

Black mass is the fine powder recovered after dismantling and shredding lithium-ion batteries, containing lithium, cobalt, nickel, manganese, copper, and other materials.

Hydrometallurgy is generally preferred because it offers higher recovery rates, better purity, and lower operating costs for small to mid-size plants.

Hydrometallurgical refining costs ₹22,000–₹38,000 per tonne, while pyrometallurgical processes can cost ₹40,000–₹55,000 per tonne.

Commonly recovered metals include lithium, cobalt, nickel, manganese, copper, and occasionally aluminum and iron depending on the battery chemistry.

Yes. Hydromet plants can achieve operating margins of 30–48% depending on chemistry mix, recovery rates, and process efficiency.

Assertively conceptualize cooperative potentialities with process centric internal or "organic" sources. Authoritatively pontificate B2C metrics via one-to-one synergy.