- Home

- About Us

- Services

- Resources

- Contact Us

- Home

- About Us

- Services

- Resources

- Contact Us

When Aman, a small logistics fleet operator from Noida, tried to dispose of his ageing trucks, he was struck by how unstructured the process still felt. Informal scrap yards offered unclear documentation, unpredictable prices, and no guarantee that his vehicle would be deregistered properly. When he learned that Uttar Pradesh was becoming a national hub for formal scrapping units, he realised the business potential behind a compliant, well-run facility.

Many entrepreneurs in UP are now thinking the same way. If you are exploring how to set up a Vehicle Scrapping Plant in Uttar Pradesh, this guide translates policies, approvals, costs, and opportunities into a practical roadmap.

Uttar Pradesh has one of the largest registered vehicle populations in India, making it a natural hotspot for End-of-Life Vehicles (ELVs). The state’s position along major freight and passenger corridors brings a continuous flow of commercial, passenger and government vehicles nearing the end of their operational life.

What makes UP particularly attractive is the scale of formalisation. The state is proactively developing registered scrapping facilities, driven by urban pollution goals, cleaner mobility ambitions, and the need to recycle metals efficiently. This creates a favourable environment for investors who want to enter early in a rapidly maturing sector.

Each of these cities offers unique sourcing advantages, industrial linkages and logistical strengths. Choosing the right location can significantly influence your plant’s performance.

Noida benefits from its proximity to Delhi NCR, where vehicle density is extremely high. As neighbouring states enforce stricter age limits, ELVs flow naturally into facilities in Western UP. Noida’s established industrial belts also make it easier to find suitable land and utilities for a scrapping unit.

Ghaziabad sits at the intersection of major freight routes linking UP with Delhi, Uttarakhand and Haryana. Because of the city’s existing vehicle repair and transport ecosystem, sourcing accident-damaged and end-of-life commercial vehicles is comparatively simpler.

Being the state capital, Lucknow sees substantial government fleet activity. A large number of ageing public vehicles pass through this district for deregistration, making it a stable source of ELVs. Its central location also allows easy distribution of processed scrap to steel units across the state.

Kanpur’s industrial heritage means a strong presence of metalworking, foundries and component manufacturers. This creates an immediate buyer ecosystem for dismantled materials. ELVs from both commercial and residential users add to the volume consistency.

To run a profitable RVSF, a reliable supply of ELVs is essential. In Uttar Pradesh, a variety of channels can help maintain steady inflows.

Manufacturers increasingly promote vehicle scrappage under incentive schemes. Partnering with them ensures regular supply and greater visibility.

Large fleets retire vehicles every few years. Building relationships with such operators can create predictable monthly volumes.

Total-loss vehicles provide an additional stream of ELVs. These vehicles often require proper documentation and formal scrapping for deregistration.

With ongoing fleet modernisation, government vehicles form a significant ELV category. Formal RVSFs are preferred for their transparent, documented process.

While informal scrap yards still dominate parts of the market, many are open to structured collaborations that offer them legal pathways for disposal.

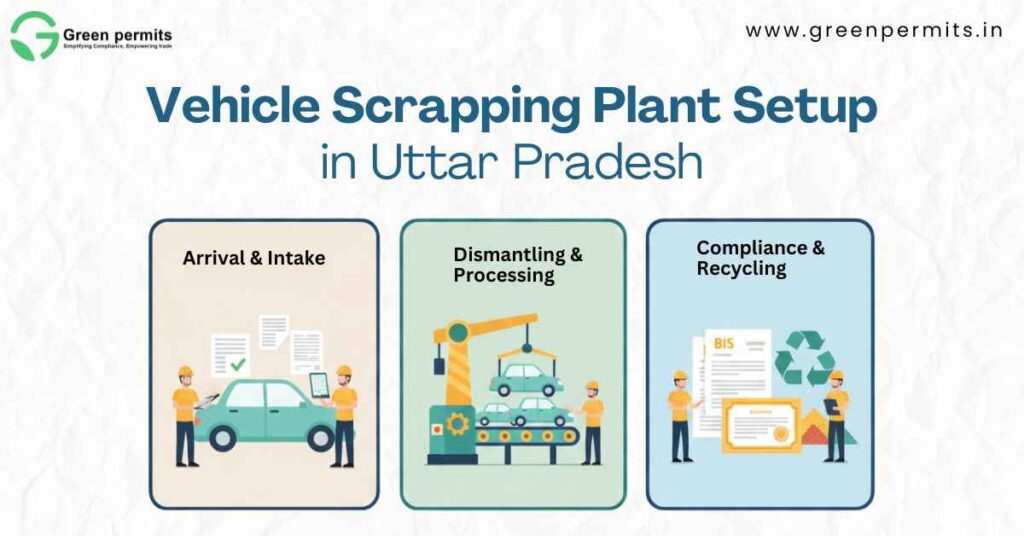

Setting up a Vehicle Scrapping Plant in Uttar Pradesh involves navigating environmental approvals and regulatory certifications. The process becomes easier when approached step by step.

Before construction or operation, you must secure:

This approval ensures your proposed site and layout meet environmental norms. Authorities examine land use, drainage, waste handling and safety infrastructure.

Granted once machinery, safety systems and pollution control infrastructure are installed. Regular compliance reporting becomes part of operations.

UPPCB approvals also cover:

A scrapping facility must be registered as an RVSF to issue valid destruction certificates. Authorities review documentation, machinery, layout, safety protocols and the applicant’s ability to follow the scrapping guidelines.

Together, UPPCB + RVSF certifications create a complete compliance backbone for your plant.

Below is a more detailed, business-friendly overview of typical costs.

| Component | 1–2 TPD Approx. | 3–5 TPD Approx. |

|---|---|---|

| Industrial land (purchase/lease) | 40–80 lakh | 1–2 crore |

| Civil infrastructure | 25–40 lakh | 50–80 lakh |

| Depollution system | 15–25 lakh | 25–40 lakh |

| Dismantling equipment | 10–18 lakh | 25–40 lakh |

| Shredder (if installed) | 35–60 lakh | 1–1.5 crore |

| ETP, oil-water separator, safety systems | 10–20 lakh | 20–35 lakh |

| Digital infrastructure (CCTV, software, networking) | 5–10 lakh | 10–20 lakh |

A smaller plant often begins with dismantling and fluid recovery only, outsourcing shredding until demand stabilises. This reduces initial investment while keeping compliance intact.

| Expense Category | Monthly Estimate |

|---|---|

| Workforce (skilled + helpers) | 3–6 lakh |

| Electricity, utilities | 1–2 lakh |

| Hazardous waste disposal | 40,000–1 lakh |

| Compliance and documentation | 20,000–50,000 |

| Security and maintenance | 40,000–80,000 |

| ELV procurement and logistics | Variable |

Operating costs depend heavily on volume utilisation. Plants running at 60–75% capacity typically reach strong profitability due to better scrap recovery and consistent metal prices.

UP’s industrial promotion policies offer practical financial relief to genuine MSME investors.

UP’s well-connected highways, economic corridors and expanding freight networks reduce inbound and outbound logistics cost. For a scrapping plant, this means faster turnaround, lower ELV pickup cost and better material distribution.

After dismantling, your main revenue comes from sorted ferrous and non-ferrous metals, reusable components and processed scrap.

Steel mills, foundries and rolling mills rely heavily on consistent scrap supply. Plants in Kanpur, Ghaziabad and nearby industrial belts can absorb high tonnage.

Copper and aluminium recyclers often offer premium rates when materials are cleanly separated and documented.

Some companies specialise in buying mixed scrap for export or secondary sorting.

Engines, alternators, gearboxes, tyres and catalytic converters can be refurbished or sold to specialised buyers where legally permitted.

Building a diversified buyer base helps stabilise revenue even when scrap prices fluctuate.

A compliant RVSF must follow strict guidelines on:

Non-compliance can lead to temporary suspension of operations, environmental compensation charges or loss of registration. Many new entrepreneurs realise that regular audits, proper storage and process discipline protect both their business and their workers.

Here is a straightforward sequence for setting up a Vehicle Scrapping Plant in Uttar Pradesh:

With Uttar Pradesh rapidly emerging as a scrappage hub, early movers enjoy access to better land, more reliable sourcing channels and stronger market visibility. As ELV regulations become stricter nationwide, demand for compliant RVSFs will rise sharply. Starting early helps avoid approval bottlenecks and positions your plant to serve both private and government sectors.

📞 +91 78350 06182

📧 wecare@greenpermits.in

You must secure industrial land, apply for CTE from UPPCB, install dismantling and depollution equipment, get RVSF registration, and finally obtain CTO before starting operations.

A 1–5 TPD scrapping unit typically requires ₹1.5–4 crore depending on land cost, machinery choice and compliance infrastructure.

You need UPPCB’s Consent to Establish (CTE), Consent to Operate (CTO) and registration as a Registered Vehicle Scrapping Facility (RVSF) under national scrappage rules.

Yes. UP has one of India’s largest vehicle populations, strong government support and consistently high ELV availability, making it ideal for new RVSFs.

Revenue comes from sale of ferrous and non-ferrous metal scrap, reusable vehicle components, and value-added processing like shredding and segregation.