- Home

- About Us

- Services

- Resources

- Contact Us

- Home

- About Us

- Services

- Resources

- Contact Us

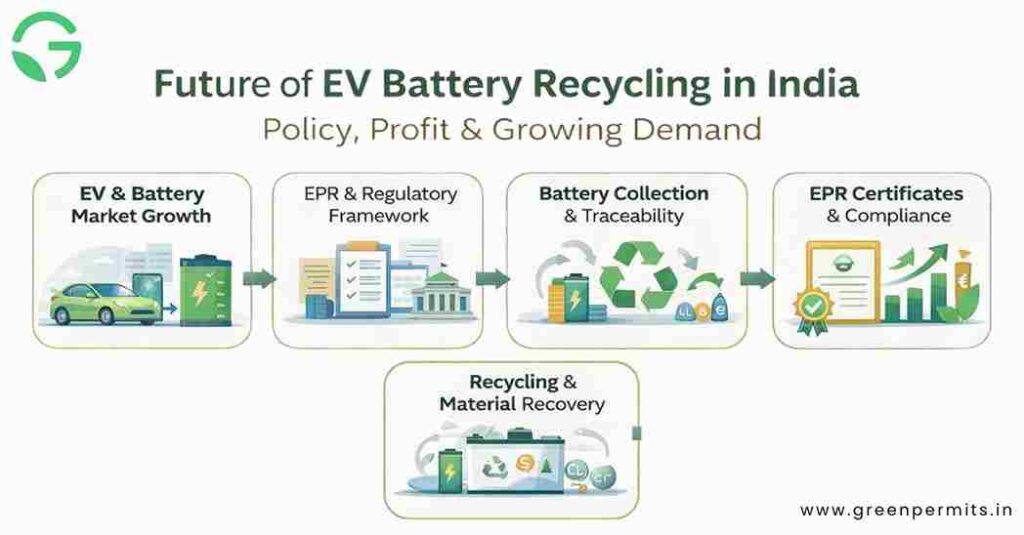

Electric vehicle adoption in India is accelerating due to government incentives, rising fuel costs, and sustainability commitments from corporates. As EV penetration increases across two-wheelers, passenger vehicles, and commercial fleets, the volume of end-of-life batteries is also set to rise sharply.

For businesses operating anywhere in the EV ecosystem, battery recycling is no longer a future concern. It is becoming a regulatory requirement, an operational responsibility, and a strategic business decision that directly impacts cost, continuity, and compliance.

EV batteries are fundamentally different from traditional waste streams. They contain high-value and hazardous materials that require controlled handling, recovery, and disposal.

From a business standpoint, this creates multiple pressure points:

Companies that delay planning for battery recycling often face disruptions when audits, renewals, or expansions are initiated.

India has moved away from fragmented waste handling toward a centralized compliance structure for batteries. EV battery recycling is governed under Battery Waste Management Rules, with implementation routed through CPCB-managed online portals.

For businesses, this means compliance is now digitally tracked, auditable, and enforceable rather than informal or discretionary.

One of the most common misconceptions is that recycling responsibility lies only with recyclers. In reality, liability begins at the point of market introduction.

Each category has separate registration requirements, reporting duties, and operational conditions. Incorrect classification often leads to portal rejections or compliance delays.

Battery recycling compliance is not limited to a single approval. It is a structured process involving multiple regulatory checkpoints.

Missing or inconsistent documentation is one of the biggest reasons applications get delayed or flagged.

India’s EV growth directly translates into long-term recycling demand. Battery waste generation is expected to increase year-on-year as early EV models reach end-of-life.

This creates a clear advantage for businesses that establish compliance early rather than reacting later.

EV battery recycling is often discussed only in sustainability terms, but the commercial upside is significant when compliance and operations are aligned.

Profitability depends less on scale alone and more on regulatory readiness and operational discipline.

Regulatory action in battery recycling is often triggered during routine processes such as audits, portal verification, or expansion approvals.

These issues can result in penalties, license suspension, or delays in import and sales operations.

Businesses that treat battery recycling as a foundational compliance requirement rather than a post-sales activity gain structural advantages.

In contrast, reactive compliance often leads to rushed filings, higher costs, and operational stress.

Green Permits helps businesses navigate EV battery recycling requirements with clarity and speed. Our role is to remove regulatory complexity so companies can focus on growth.

We assist with:

📞 +91 78350 06182

📧 wecare@greenpermits.in

👉 Book a Consultation with Green Permits

Yes. Businesses placing batteries or EVs in the market must comply with battery waste rules.

Manufacturers, importers, and battery producers are required to register.

No. Recycling without registration is considered non-compliant.

Authorities may impose penalties or restrict business operations.

Yes, especially for compliant recyclers with approved infrastructure.

By managing registrations, filings, and end-to-end compliance support.