Amit Aggarwal runs a mid-sized FMCG packaging business in Noida. His products are doing well, distributors are happy, and operations are smooth. But one routine check of the CPCB portal changed his mood completely — “EPR obligation pending.”

Amit had heard about plastic EPR credits, but no one had explained them in simple terms. Where do you buy them? Why do prices change? What if the portal doesn’t reflect the credits on time? Like many North Indian manufacturers, he realised that EPR compliance was no longer just paperwork — it directly affected cost, risk, and continuity of business.

If you’ve faced similar confusion, this guide is for you.

Plastic EPR credit trading is the official compliance mechanism through which producers, importers, and brand owners fulfil their Extended Producer Responsibility obligations under India’s Plastic Waste Management Rules.

From a business perspective, it exists because regulators want companies that introduce plastic into the market to also take responsibility for its recycling.

In practical terms, this means:

These credits act as documented proof that an equivalent quantity of plastic waste has been recycled on your behalf by an authorised entity.

Key clarity most businesses miss:

Businesses typically covered include:

Before any credit can be purchased or transferred, it must be generated correctly within the compliance system.

Plastic EPR credits are generated only when recycling actually happens and is verified.

The generation process works like this:

Only after this approval do credits become eligible for transfer to PIBOs.

An important operational detail is that credits are linked to plastic categories, not just quantity. This classification directly affects availability, pricing, and compliance validity.

Plastic categories include:

Buying the wrong category of credit — even if quantity matches — can invalidate compliance during audits.

Pricing is where most businesses either overspend or make costly mistakes.

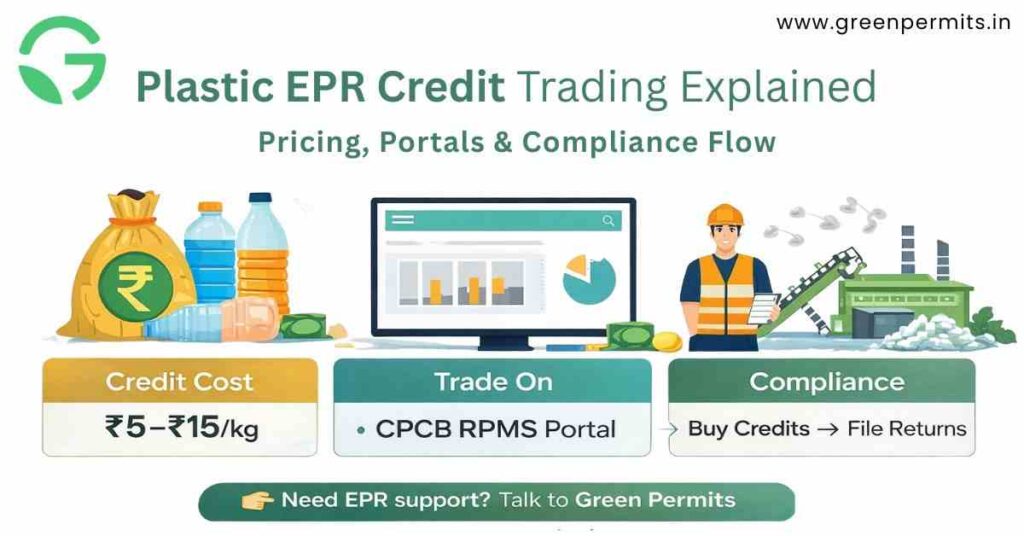

Plastic EPR credit prices are not fixed by the government. They are influenced by supply, demand, and recycling complexity within each plastic category.

In the Indian market, businesses typically encounter these price ranges:

What pricing really tells a business:

Many companies only look at price per kilogram. Experienced compliance teams look at price predictability, portal timelines, and verification risk.

EPR credit prices do not rise randomly. They change due to very practical reasons within the compliance ecosystem.

Common reasons for price fluctuation include:

A common pattern seen every year is that prices rise sharply between January and March. Companies that wait until the last quarter often pay significantly more than those who plan ahead.

Understanding the role of each portal prevents last-minute surprises.

The CPCB Plastic EPR Portal is the central authority system where all compliance is ultimately evaluated. It is used for:

In addition to the CPCB portal, recyclers operate their own dashboards where credit generation begins. In some cases, approved trading or settlement platforms are used to document transfers.

One critical rule businesses must remember:

Many penalties occur simply because businesses do not understand the full compliance flow.

A typical end-to-end compliance journey looks like this:

If any step is skipped, delayed, or mismatched, compliance remains incomplete — even if payment has already been made.

Most non-compliance cases are unintentional. They occur due to misunderstanding, delay, or incorrect documentation.

Common risks include:

Consequences can be serious and disruptive:

In several audit cases, businesses believed they were compliant — until CPCB records showed otherwise.

A Pune-based FMCG brand planned its EPR credit requirement early in the financial year. By locking credits in advance, the company avoided seasonal price hikes and completed annual filing smoothly.

In contrast, an electronics importer based in Chennai waited until the end of the year. Flexible plastic credits were scarce, prices had increased, and portal approvals were delayed — resulting in compliance notices and unnecessary stress.

The difference between the two cases was not intent, but timing and planning.

Plastic EPR compliance today is as much about operational planning as it is about regulation.

Businesses that plan early benefit from:

Treating EPR as a year-end task almost always leads to higher costs and avoidable risk.

Plastic EPR credit trading is now a permanent part of doing business in India.

Companies that treat it as a routine, planned activity experience:

Those who delay often face penalties, inflated prices, and operational disruption.

If you are unsure whether your credits, pricing, or portal records are accurate, that uncertainty itself is a compliance risk worth addressing early.

📞 +91 78350 06182

📧 wecare@greenpermits.in