A growing electronics brand had everything in place — suppliers, distributors, even online sales ticking up nicely. But one email from a marketplace changed things overnight: “Please upload your E-Waste EPR Registration Certificate to continue sales.”

What followed was confusion, panic calls, missed deadlines, and finally the realization that E-Waste EPR is not optional — it’s mandatory business compliance in India.

If you manufacture, import, or sell electrical and electronic products in India, this guide will walk you through what E-Waste EPR registration is, who needs it, and how to complete the process without delays or penalties.

Extended Producer Responsibility (EPR) under the E-Waste (Management) Rules, 2022 makes businesses responsible for the collection, recycling, and environmentally safe disposal of electronic waste generated from their products.

E-Waste EPR Registration is the mandatory approval issued by CPCB through its centralized portal, allowing you to legally place electrical and electronic equipment (EEE) in the Indian market.

Without registration, your business is considered non-compliant, regardless of scale.

If your business falls into any one of the categories below, registration is mandatory.

Even startups and first-time importers are covered from day one of sales.

Many businesses assume EPR applies only after large volumes. In reality, the obligation starts the moment products enter the Indian market.

The CPCB has notified a wide range of products under Schedule I of the rules.

If your product runs on electricity or electronics — EPR likely applies.

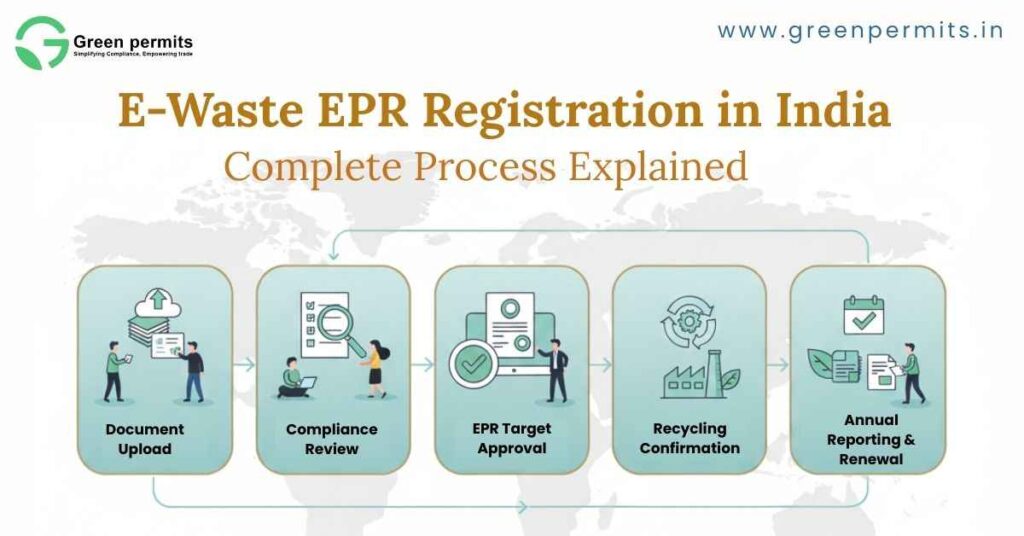

The entire registration is done online through the CPCB EPR Portal. However, most rejections happen due to incomplete understanding of what the portal actually requires.

Account Creation

Entity & Business Details

Product & Sales Data Submission

Document Uploads

EPR Obligation Generation

Application Review by CPCB

| Document | Purpose |

|---|---|

| GST Certificate | Business identity |

| PAN (Company & Authorized Person) | Legal verification |

| IEC (Importers) | Import compliance |

| CA Sales Certificate | Sales validation |

| RoHS Declarations | Hazardous substance control |

| Awareness Plan | Consumer awareness obligation |

Insight for businesses:

Most delays occur due to incorrect sales data or mismatched addresses across documents.

EPR registration fees are linked to your annual e-waste recycling obligation, not company size alone.

| Annual E-Waste Target (MT) | CPCB Fee (₹) |

|---|---|

| Below 50 MT | 2,500 |

| 50–100 MT | 7,500 |

| 100–1,000 MT | 1,50,000 |

| 1,000–5,000 MT | 10,00,000 |

| Above 5,000 MT | 15,00,000 |

What this means:

Early and accurate reporting helps avoid unnecessary higher fee slabs.

| Parameter | Details |

|---|---|

| Registration Validity | 5 Years |

| CPCB Review Time | Up to 30 working days |

| Query Response Time | 7 working days |

| Renewal Window | 120 days before expiry |

Business takeaway:

Late responses or missed timelines can lead to application closure or suspension.

Non-compliance doesn’t just mean fines — it directly affects operations.

Businesses that register early benefit from:

EPR is no longer a checkbox — it’s part of business continuity planning.

At Green Permits, we handle end-to-end E-Waste EPR compliance, including:

You focus on growth — we handle compliance.

E-Waste EPR Registration in India is mandatory, structured, and closely monitored.

Ignoring or delaying it can disrupt sales, imports, and investor confidence.

Early registration means:

📞 +91 78350 06182

📧 wecare@greenpermits.in