- Home

- About Us

- Services

- Resources

- Contact Us

- Home

- About Us

- Services

- Resources

- Contact Us

Arjun, the operations head at VoltEdge Imports Pvt. Ltd., thought the Battery EPR annual return would be a simple formality. But as he logged into the CPCB portal a week before the deadline, he realized that half of his daily sales data was incomplete, battery compositions were mismatched, and the system showed unresolved obligations.

Like many Indian importers, Arjun wasn’t careless — he was simply unaware of the level of detail the portal expects.

If you’ve ever felt the same pressure during compliance season, this guide will walk you through annual return filing in a clear, business-friendly way.

Battery EPR annual returns are mandatory for all importers who place batteries or battery-powered products on the Indian market. Annual return filing is not just paperwork — it’s CPCB’s way of confirming that you have fulfilled your Extended Producer Responsibility (EPR) obligations for the year.

Annual returns are the mechanism through which CPCB validates:

Before you start the process, ensure you have:

Annual returns directly determine:

When done correctly, your annual return protects your business from delays and demonstrates credibility to regulators.

| Annual Return Section | What You Must Enter | Documents Needed | Why It Matters |

|---|---|---|---|

| Sales / Import Summary | Full FY data in KG & units | GST invoices, BOEs | Determines your final obligation |

| Daily Sales Data | Battery type, composition, quantity | Sales invoices | Ensures accuracy of EPR targets |

| EPR Certificates | Metal-wise certificates | Certificate PDFs | Confirms completion of obligations |

| Awareness Activity | Details + evidence | PDFs, images | Mandatory section for importers |

| Declaration | Final confirmation | None | Confirms responsibility and accuracy |

Importers often face return rejections because the above sections don’t align with each other — especially daily data vs annual summaries.

For battery importers, daily sales data isn’t optional. It’s one of the strictest parts of the EPR framework. CPCB uses this information to calculate obligations for each metal inside a battery — such as lithium, cobalt, nickel, manganese, or lead.

Every sale or dispatch must include:

The system automatically:

Most importers update their daily data only at the end of the financial year — resulting in:

Daily discipline makes annual filing far simpler.

| Field | Example Entry | Why It Matters |

|---|---|---|

| Battery Type | Portable Li-ion | Defines category of waste |

| Chemistry | NMC Li-ion | Determines metal list |

| Composition (%) | Li 4%, Ni 8%, Mn 10%, Co 12% | Drives obligation calculation |

| Quantity Sold | 150 pcs / 90 kg | Basis for EPR targets |

| Invoice No. | VEP-1129 | Proof of transaction |

| Invoice Upload | PDF scan | Required for validation |

| Product Name | Laptop Battery Pack | Ensures accuracy with registration |

| Sale Date | 12-Feb-2024 | Ensures period correctness |

Getting any of these wrong leads to obligation mismatches during annual return filing.

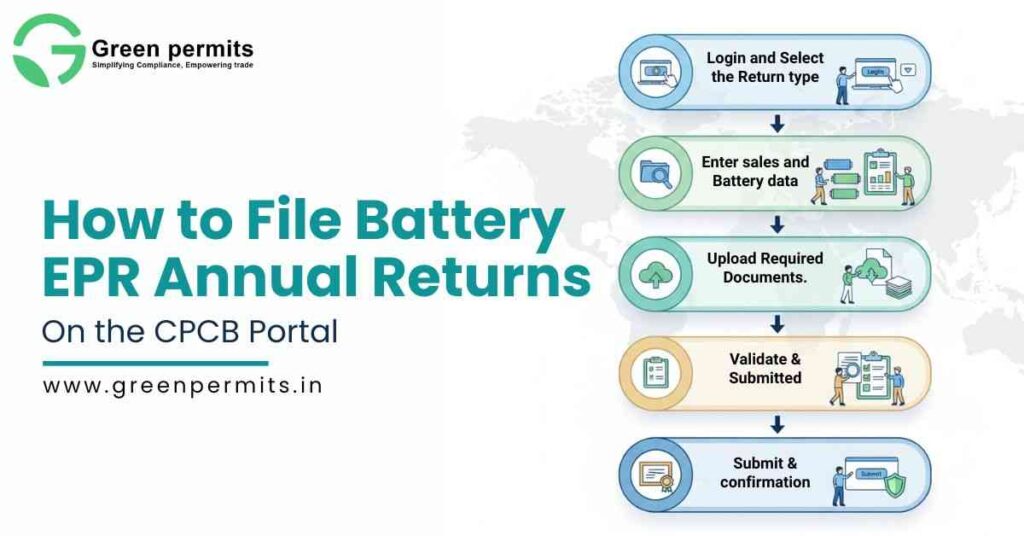

Annual return filing follows a structured and predictable flow. Once you understand the logic behind each step, the process becomes manageable — even if you’re a first-time importer.

Go to your dashboard, click Returns, and select Annual Return for the relevant financial year.

The portal automatically pulls everything you have submitted so far:

Check:

The portal shows:

If the obligations look incorrect, the problem usually lies in daily sales entries — fix those first.

This section is mandatory.

Your awareness activity may include:

Upload all supporting evidence.

Make sure:

Once submitted, the return cannot be edited — double-check everything before final submission.

Annual return filing is one of the most monitored elements of the Battery Waste Management framework. Missing or incorrect returns can lead to real operational consequences.

Compliance isn’t only about avoiding penalties — it’s also about maintaining smooth business operations.

Even the most organized teams slip up during annual return season. These are the mistakes that almost always lead to rejections.

Filing Battery EPR annual returns may feel tedious at first, but once you understand the structure — daily data → obligation calculation → certificate matching → awareness proof → final submission — the process becomes predictable and manageable.

By maintaining accurate entries throughout the year and following a stepwise approach, you can avoid compliance issues, save time, and ensure smooth business operations.

📞 +91 78350 06182

📧 wecare@greenpermits.in

Book a Consultation with Green Permits

Any importer placing batteries or battery-powered products in India must file annual returns on the CPCB portal.

Annual returns must be filed by 30 June every year for the previous financial year.

Yes, daily sales data with invoice uploads is required to calculate accurate metal-wise EPR obligations.

No, once submitted, the annual return cannot be revised on the portal.

You need GST invoices, import details, daily sales data, battery composition, EPR certificates, and awareness activity proof.